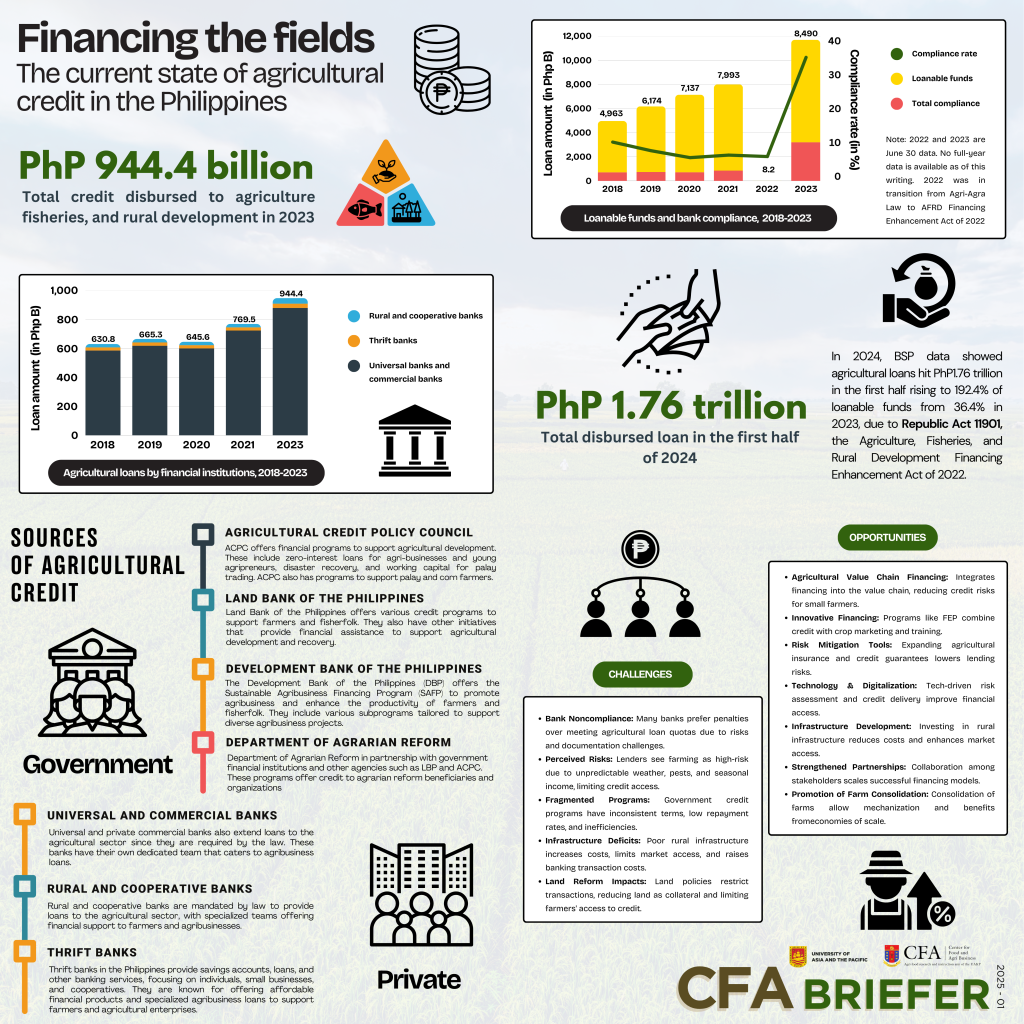

This insightful piece explores agricultural financing challenges and opportunities, focusing on credit availability and accessibility for farmers and agribusinesses. It examines the state of agricultural credit, existing financial programs, lending trends, and funding barriers while highlighting innovative solutions to drive sustainable growth. A must-read for those invested in Philippine agriculture!

by Joy Kristel L. Orzales, Senior Agribusiness Specialist, Center for Food and Agri Business, UA&P

THE AGRICULTURAL CREDIT SECTOR in the Philippines plays a critical role in supporting farmers and fisherfolk through a variety of financial instruments and programs. These mechanisms, ranging from credit programs to guarantee schemes and agricultural insurance, are designed to address the sector’s unique challenges, including the need to improve access to finance, enhance productivity, and foster rural development.

Despite the availability of these programs, the agricultural credit landscape is marked by a significant gap between the demand for credit and the supply provided by financial institutions, underscoring the need for innovative solutions.

Do you want to read the full article? Please answer this form and we will send the article to your email address.